100Home

NSSF New Deduction Rates, Teachers & Civil Servants per Grade

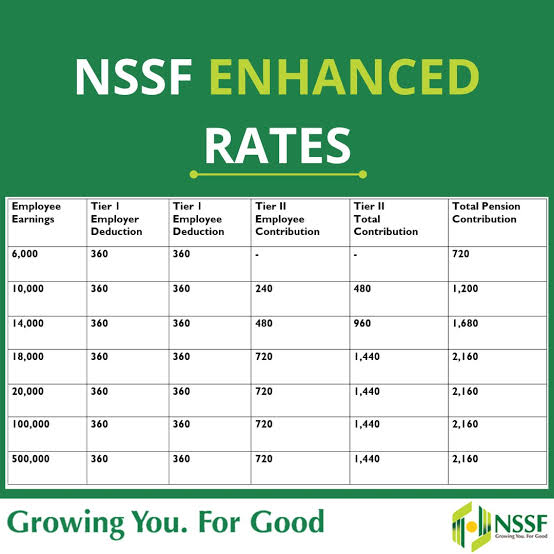

A document released by National Social Security Fund (NSSF) indicates new deduction rates from teachers, Civil Servants and other workers monthly of between Ksh.420 and Ksh.1,740 monthly from their payslips.

NSSF notice details structural new rates which indicate that the lower earnings limit or the amount per month has considered the lowest pensionable salary has been raised to Ksh.7,000.

Preciously, the above amount was Ksh.6,000 and therefore the category of employees within the above category will now contribute Ksh.420 from the current Ksh.360 monthly contribution.

On the other hand, those under the Upper Earnings Limit has also been changed and raised to 29, 000 up from the current Ksh.18,000.

Therefore, the above bracket which consist of most workers will be subjected to a deduction of Ksh.1,740 from the Ksh.1,080 per month.

According to the NSSF, the employer must match each contribution made by the employee just like the current operation.

Revised rates will remain in place until the next review expected in January 2025.

This new NSSF deduction plan, which took effect last year, is expected gradually increase its rates over a period of 5 years.

New NSSF contributions Rates that will affect workers in different salary scales

All the Employers are expected to release matched contributions , same as those made by employees

| Monthly

Salary scale |

Previous

NSSF contribution |

New

NSSF contribution |

| 10,000 | 600 | 600 |

| 18,000 | 1,080 | 1,080 |

| 20,000 | 1,080 | 1,200 |

| 30,000 | 1,080 | 1,800 |

| 36,000 | 1,080 | 2,160 |

| 50,000 | 1,080 | 2,160 |

| 100,000 | 1,080 | 2,160 |

Here is the additional NSSF indicating new deductions starting February 2024 based on a notice to all Employers, starting February 2024 payroll.

A male teacher in a class Photo/ Courtesy UNICEF Kenya

This is the new NSSF Contribution Rates for the Second Year, 2024 rates

YEAR 2 CONTRIBUTION /DEDUCTION RATES, 2024

The deduction is made in accordance with the Third Schedule of the NSSF Act 2013

| Lower Limit under

[Tier 1] |

7,000.00 |

| Total NSSF Contribution by Employee | 420.00 |

| Total NSSF Contribution by Employer | 420.00 |

| Total Tier 1 Contributions | 840.00 |

| Upper Limit under

[Tier 2] |

36,000.00 |

| NSSF Contribution on Upper Limit (it is 6% of upper Limit less Lower nssf Limit) | 29,000.00 |

| Total NSSF Contribution by Employee | 1,740.00 |

| Total NSSF Contribution by Employer | 1,740.00 |

| Total Tier 2

Contributions |

3,480.00 |

| NSSF Total Contributions | 4,320.00 |

Note that according to the NSSF, the Remittances of the Fund should be made by the 9th day of each subsequent month regularly.